What’s causing the recent market volatility and selloff?

Our 2022 road trip just started — did we get a flat tire already?

The start of 2022 hasn’t been kind to U.S. equity investors. As of Friday January 21, 2022, early afternoon, the Dow Jones Industrial Average, S&P 500, and NASDAQ Composite price indices were down approximately 5%, 7%, and 11%, respectively since the calendar changed to 2022. The NASDAQ has also fallen into correction territory, as it is down more than 10%. What are the reasons for the market weakness? We believe that the change in sentiment towards risky assets in the short term can be tied to the uncertainty around the path of the U.S. Federal Reserve’s rate hikes. In very short manner, the consensus now believes that the Fed will increase rates four times instead of two to fight against elevated levels of inflation. That has resulted in a 32-basis point jump in the U.S. 10-year Treasury yield.

While the Fed has communicated that it’s likely to begin raising interest rates sooner than originally expected, we don’t believe this is a cause for concern. In our view, despite the short-term volatility that a pivot in monetary policy will create, it’s a positive development. The Fed is signaling that they no longer feel the economy needs the ultra-accommodative monetary policy implemented during the peak of the crisis in early 2020. They’re simply reducing the additional support. The Fed isn’t raising rates from a neutral posture but rather starting to move away from the zero bound. In the short term, markets tend to react negatively to the idea of the Fed taking away the proverbial punchbowl at the party, but this doesn’t mean the party is over. It implies the party won’t be as entertaining, but fun, nonetheless.

Higher growth companies that have benefited from low interest rates to support their longer duration revenue streams are bearing the brunt of this shift in yields. “Don’t throw the baby out with the bathwater” comes to mind with the recent selloff as good quality businesses are getting caught up in the downturn. This can be explained in part to the increased adoption of passive vehicles. For example, the big three providers who account for nearly 80% of the U.S. exchange-traded fund (ETF) market collectively own about 22% of any typical S&P 500 company, up from 13.5% in 2008.

We’re also in the early stages of Q4 earnings season, and the market seems to be rewarding or punishing individual companies based on their announcements. It’s not just about Q4 results but also their forward guidance. Supply chain issues and elevated input costs are creating uncertainty for some companies over the next few quarters, and this is adding to some of the price pressure.

Geopolitical risk is also factoring into the market unrest, as renewed tensions between Russia and Ukraine, among others, top headlines. Geopolitics are always simmering in the background, but when there are flare-ups, we often see short-term market reaction. However, recent history shows that these are usually disruptive rather than destructive to the markets.

For the long-term investor, it’s important to remain focused on the fundamentals. Nothing has changed from our view, which we outlined in our 2022 outlook. In our Investment Note, we said to expect some pit stops along the way during our road trip this year, and this one came a little earlier than anticipated. We just set off on our road trip … and two blocks away, we forgot to close the garage door.

We must take a step back during these pit stops and ask ourselves, “What are the risks of a recession over the coming year?”

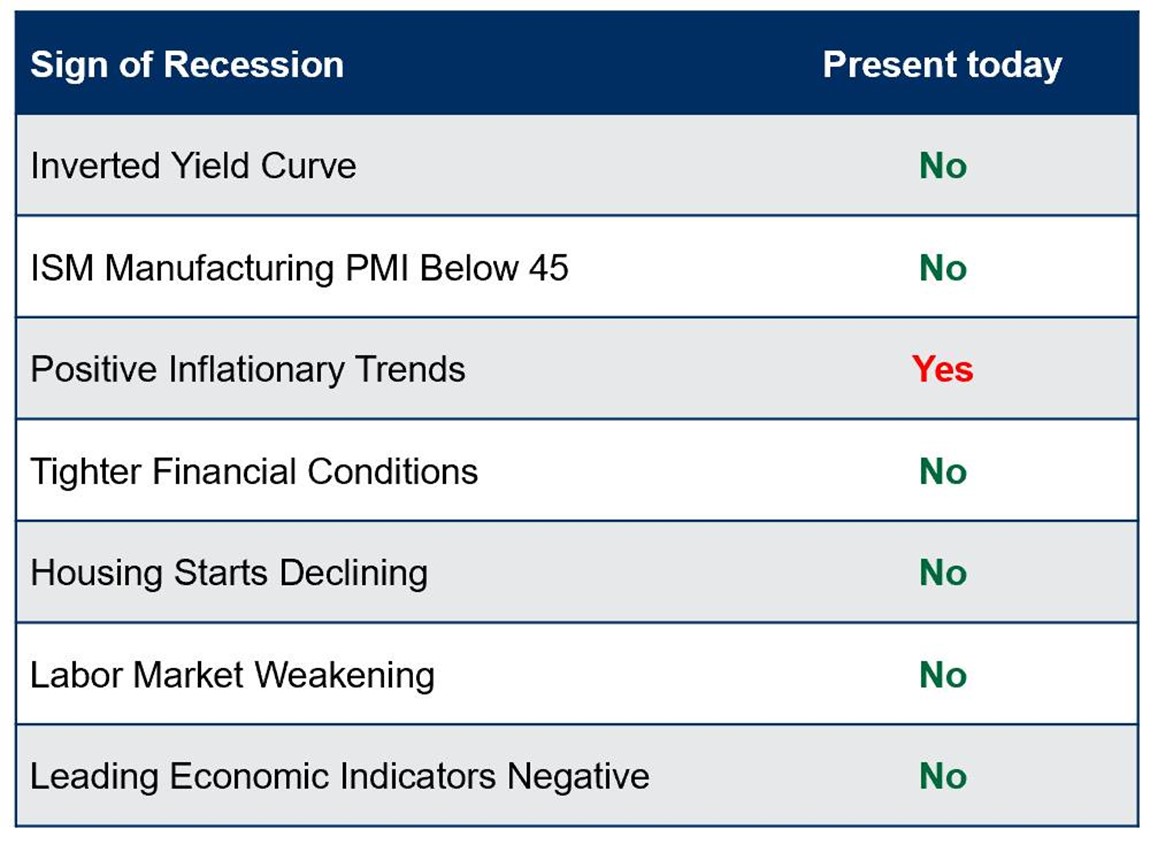

There are usually leading indicators to a recession — the most prevalent is an inverted yield curve. Based on our list of indicators below, we currently only have one of the typical signs of a recession and, as such, we continue to believe recessionary risk in 2022 remains low. Since most bear markets coincide with recessions, we don’t anticipate this near-term market volatility to cause a significant decline from these levels.

Typical signs of a recession aren’t present

Source: Capital Markets Strategy, Bloomberg, as of December 31, 2021

Source: Capital Markets Strategy, Bloomberg, as of December 31, 2021

We can also look at U.S. Conference Board Leading Economic Index (LEI) as an example of the health of the economy. The current level would suggest that the U.S. economy is in a stable position in 2022. Excluding the recent self-induced recession caused by the pandemic, since 1970, a recession and market peak occurred six months, on average, after the LEI became negative.

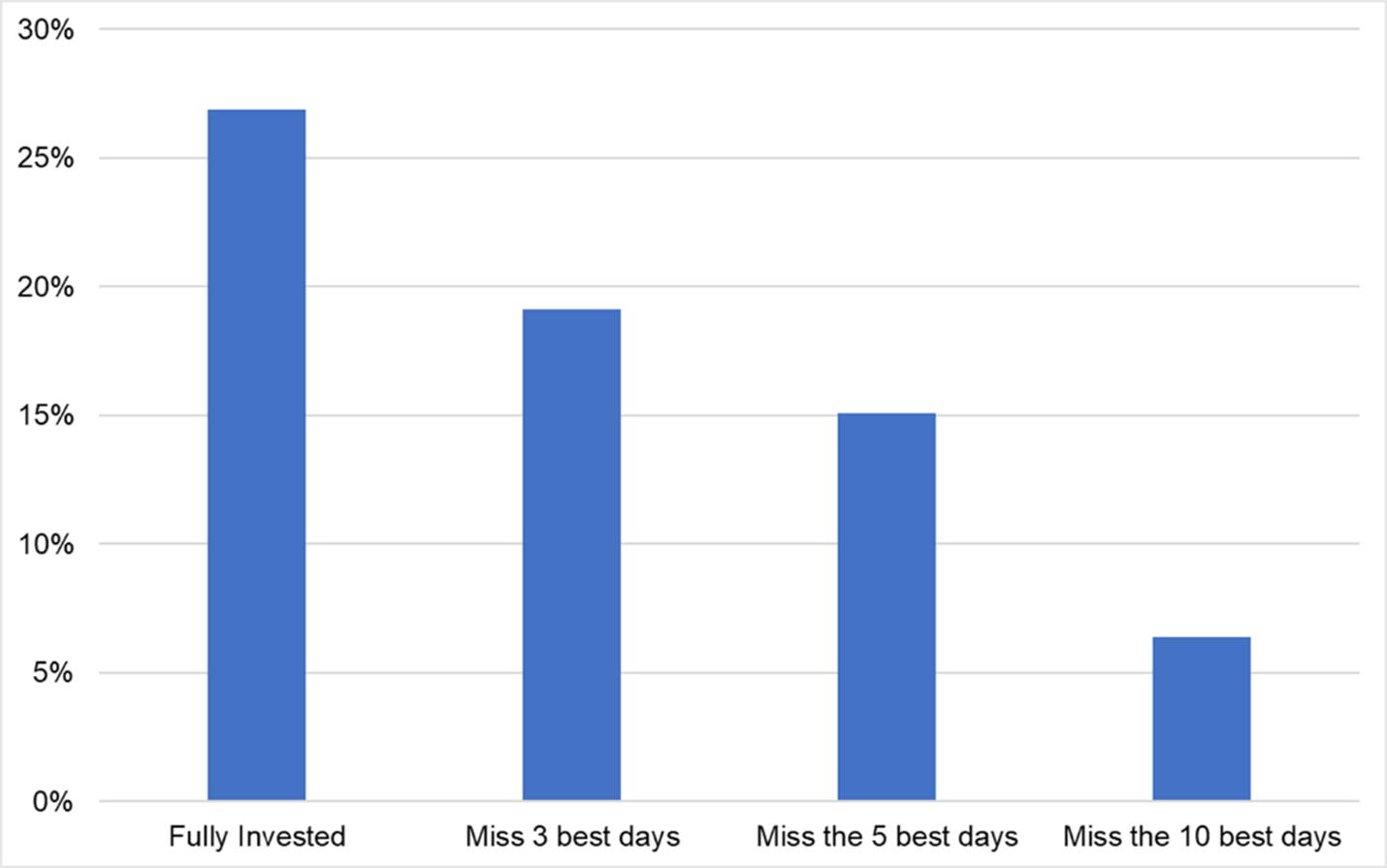

A correction is entirely possible in the near term, and recent strong equity markets can sometimes cause overconfidence. Some investors start to think they can time the markets — get out and in at the “right time.” What if they’re wrong? As the table below illustrates, in 2021, missing the best days in the market can have a meaningful impact even in the short term. Remember, it’s time in the market, not timing the market, that matters.

Value of staying invested (S&P 500), 2021 return profile under various scenarios

Source: Capital Markets Strategy, Bloomberg, as of December 31, 2021

Source: Capital Markets Strategy, Bloomberg, as of December 31, 2021

Throughout the pandemic, we’ve been advocating rebalancing portfolios to target asset allocations and dollar-cost averaging into this market. We continue to emphasize that approach today. We don’t know what the market holds for us over the near term. But while market volatility creates uncertainty, we need to take these pit stops in stride and focus on the road ahead to make sure we arrive at our destination.

If you’d like to discuss this topic in greater detail or have any questions, please reach out to a

member of your Arbutus Financial Team.