Have you created an estate plan? Thoughtful estate planning can help achieve many powerful, important goals. The main goal is to make sure assets flow to the intended beneficiaries in the most efficient and tax-effective manner. Another goal should be to open up transparent conversations between those giving and receiving wealth. Failure to have these conversations can sometimes rip families apart even over very insignificant dollar amounts just because of the symbolic or sentimental nature of certain estate assets.

What’s an estate plan, anyway?

Estate planning sounds like a lofty term but it’s simply a formal way to answer the questions, “Who”, “What”, and “When” about your assets. For example, “What assets do we want to go to whom, and when do we want them to be given (during the lifetime, at death, or after death?)

The building blocks of an estate plan typically include writing a will or wills, assigning a power of attorney, and designing a beneficiary on a life insurance policy.

Having an estate plan allows you to leave the most money possible to your loved noes, as well as to charitable causes. Most provinces charge a probate fee to process your will that’s based on the total amount of your assets at the time of your death. A well-designed plan can minimize probate fees and taxes. It can also reduce potential legal costs and delays in the case of disputes.

According to a recent Manulife Investment Management State of Estate Planning survey, a substantial proportion of Canadians are not fully prepared for wealth transfer.

Some highlights:

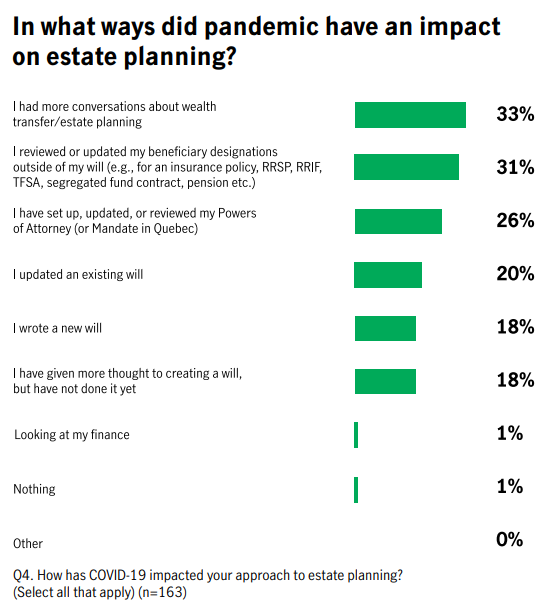

- Nearly one-in-five (19%) respondents said the pandemic has impacted their approach to estate planning.

- Those who have a will/estate plan are increasingly discussing it with both their financial advisor and beneficiaries.

- Those who expect to inherit wealth are less likely to report discussing the situation with their financial advisor than they did during the last days of pre-pandemic times in early 2020.

- Receiving an inheritance is taking longer than expected.

- Fewer Canadians (23%) say they have a written financial plan than those did prior to the arrival of the pandemic.

Pandemic issues aside, a substantial proportion of Canadians are not fully prepared for wealth transfer. The survey revealed that 46% continue to live life without ANY of the following:

- Financial advisor

- Written financial plan

- Formal estate plan

Among those who do not have an estate plan, lack of wealth was the most cited reason.

Advisors can make a big difference in the lives of Canadians. Two independent studies confirm that working with an advisor has a direct positive effect on investments and household savings, compared to households without an advisor.

Working with Arbutus Financial, we can help you develop a robust, detailed and documented estate plan, along with clear communication. This can go a long way in ensuring smooth wealth transfer and minimizing any family conflict.

Click here for the full report from Manulife:

The State of Estate Planning in Canada

If you would like to discuss these topics in greater detail or have any questions, please reach out to a member of your Arbutus Financial Team.

Further Reading:

Estate planning: the pandemic effect on family finances

Protecting your nest egg when you’re gone

Estate-planning opportunities using insurance investment contracts