As of January 1, 2017, changes will be made to the Insurance Act that will impact insurance benefits. New mortality tables and new rules are being adopted in the insurance industry which reflect the fact that people are living longer and their insurance policies will pay out at an older age. Any insurance policies issued after January 2017 will be subject to these new rules/tables and estates – and companies – may be significantly impacted.

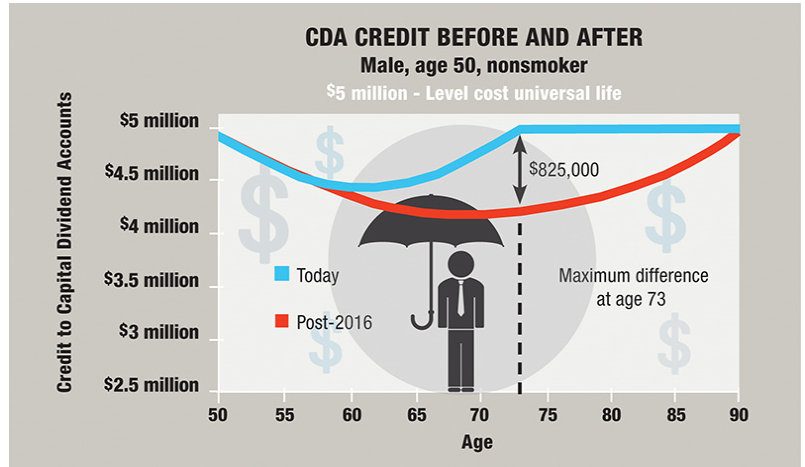

For corporately-owned plans, the Capital Dividend Account (CDA) credit resulting from the death benefit payment under the new rules may be lower, thereby reducing the amount that can be distributed as tax-free dividends to the surviving shareholders.

By making changes to your existing life insurance policy or putting new coverage in place before the end of 2016, your policy will be grandfathered so that you will have more flexibility in the future and potentially saving your estate or company a substantial amount of money.

To learn more about these upcoming changes, you can check out this thorough overview from CPA Canada or contact an Arbutus Financial team member.